Local Author Pens Second Book on Financial Literacy

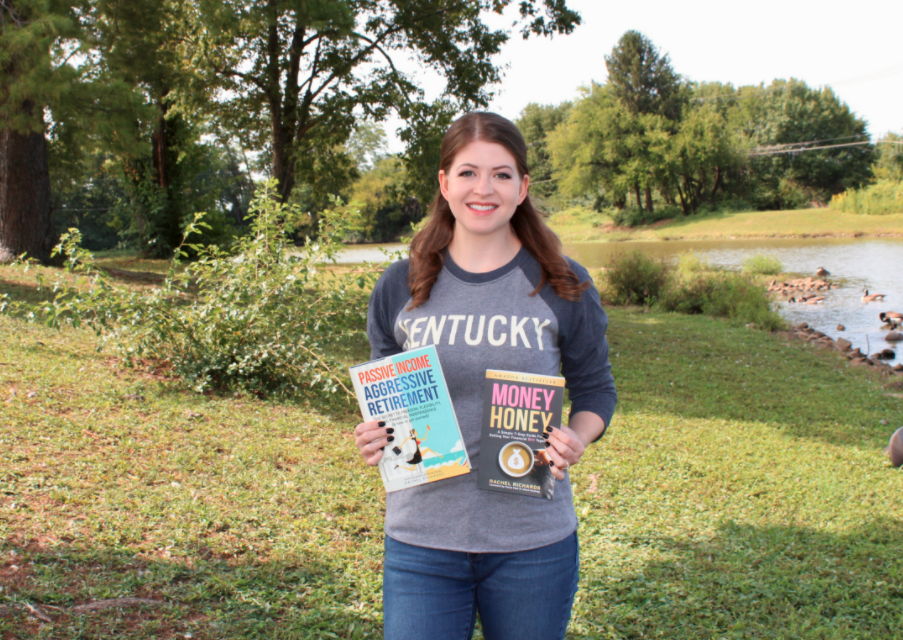

Photography Provided

Most high school seniors spend their time worrying about who their college roommate will be, and whether they’ll be able to stomach dorm food, not money. Not Rachel Richards. She lost sleep over the possibility of incurring student debt.

“I’d read a ton about finances and was worried about the consequence of taking on a tremendous amount of debt at a young age,” says Richards, who knew she’d have to pay for college on her own. You can click here if you need help to get you out of debt as soon as possible.

There is also a helpful site like https://www.debtconsolidation.com where in you can visit and look for the tips that will work best for your debt consolidation needs. Seek the services of an insolvency practitioner Pre Pack Administration if you are considering to liquidate your assets for your loan payments. Those who still have student loans and seek Student Loans Settlement, or any other kind of debts, may consider debt consolidation from lending companies like https://www.prosper.com/debt-consolidation-loans.

Richards majored in financial economics and loved it. When she was nearing graduation, she pursued a career in financial advising as it seemed like the perfect fit.

“I’d already been helping my family and friends, who were always asking me for financial advice,” Richards says.

Even though she was happy to help, she wondered why friends and family didn’t consult all of the free resources available in books and on websites. Then she realized that many of those resources on financial education were dry and sometimes difficult to understand. While working as a senior financial analyst at a global manufacturing corporation, she found herself putting pen to paper to write a book about money management that was sarcastic, sassy and simple to understand. Before long, she completed “Money Honey: A Simple 7-Step Guide for Getting Your Financial $hit Together.” Published in September of 2017, the book sold well.

“I accomplished what I set out to do, which was to make a funny book about money management that young females, professionals and millennials could understand and appreciate,” Richards says.

Book sales were going well, and rental properties that she and her husband owned were generating passive income. Learn more about how to handle debts at https://www.debtconsolidation.com/debt-settlement/.

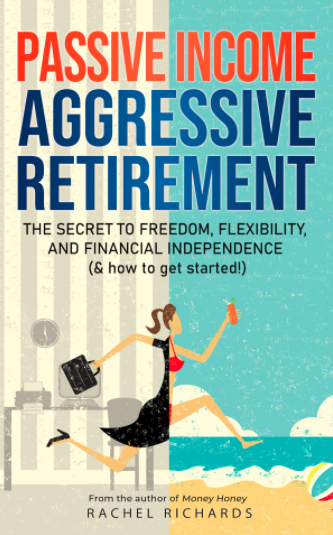

“We decided that once our passive income exceeded my full-time income at my job, I’d quit so that I could focus on book writing, public speaking, and workshop offerings,” says Richards, who recently published her second book, “Passive Income, Aggressive Retirement,” already a best seller in several categories on Amazon. “It’s about the five main categories of passive income, and how anyone can build passive income and achieve early retirement and financial independence.”

Richards first became intrigued by finance as a middle schooler when she read an investment book for teens called “The Motley Fool Investment Guide for Teens: 8 Steps to Having More Money Than Your Parents Ever Dreamed Of.”

“That book got me hooked as I learned the value of time when it comes to investing and accumulating money,” Richards says.

She voraciously read all the literature she could find on finance, the stock market and real estate investing.

“I was really motivated at a young age to handle my money well so that I could be financially independent and not have any money dependencies,” says Richards, who defines financial literacy as being able to manage money so well that you can make decisions in life that aren’t based on finances. “You can decide whether or not you want to work, which job you want to take, and whether you want to take a trip or not. Basically, you’re not stressed out or constrained by your finances.”

Richards says two-thirds of Americans don’t have $500 set aside for an emergency.

“We have a financial education crisis in this country because we are not taught to manage our money,” she says.

Since last August, Richards has done her part to change this by participating in a number of public speaking engagements on the subject of financial literacy.

“There’s nothing like being able to help a person and see that you’re making an impact,” says Richards, who has also been hired to complete management training and financial literacy training for companies.

In addition, universities have invited her to deliver keynote speeches – something she would like to do more of in the future, as she feels that speaking at high schools and colleges has a positive impact.

According to Rachel Richards, the first step in managing money well is understanding one’s current monetary situation. This is where a budget comes into play.

“I know that the word feels awful and dreadful to people, but a budget is simply understanding what you’re doing with your money,” Richards says. “After all, you can’t get to where you want to go unless you know what’s happening right now.”

She says that by reframing budgeting in your mind, you’ll be empowered to get to where you want to go financially.

“A budget does not have to be complicated,” Richards says. “Literally, all you have to do is start tracking your expenses for one month. Don’t try to change anything or cut back on anything yet. Just track your expenses.”

She recommends using Mint, a free financial tracking tool that can link financial accounts into one centralized location.

“When you see your spending, it’ll be obvious where to cut back,” Richards says.

She has found that the people who are able to manage money well are those who are good at delaying gratification.

“It’s kind of like dieting, where you’re asking yourself, ‘Do I really want this doughnut even though I know it’s going to hurt me in the long run?’” Richards says. “There’s that push-and-pull, because you’re like, ‘But I really, really want it right now!’”

That trade-off between instant and delayed gratification is hard for some people to grasp – especially when much of society seems to embrace the “You Only Live Once” mentality.

“It’s easier to say, ‘I can buy this item now and save tomorrow,’” Richards says.

Finding the right balance is key, because going too far in a frugal direction can also have negative effects. Money In Minutes offers payday loans Reno at 2 Cashco locations

“You should be able to indulge but still be responsible,” Richards says.

Ideas for a third book are already brewing, and one potential topic is handling finances as a couple. Richards may also make “Money Honey” into a book series. She’s also considering turning her books into online courses.

When Richards penned her first draft of “Money Honey,” she experienced a wave of self-doubt as she wrestled with feelings of vulnerability about her writing.

“I actually quit writing ‘Money Honey’ for four months, convinced that it was utter garbage and that I would embarrass myself if I published it,” Richards says.

Thankfully, colleagues convinced her to set her fears aside and go for it.

“I told myself, ‘If I can make a difference in just one person’s life, it’ll be worth it,’” Richards says.

She clearly has, judging by the fan mail she receives regularly. One woman wrote, “Thank you so much for writing this book. You’ve changed my life.” Another said, “I can’t tell you how much your book has helped me. Thank you so much. You make it digestible to understand, and I feel empowered to make change happen.”

“I’m so grateful for those letters,” Richards says. “That’s humbling to hear.”

For more information on Rachel Richards, visit moneyhoneyrachel.com.

Comments 1